Are you ready to disrupt with AI? Join our Hackathon today! Click to Register

By WebOsmotic Team | Published on October 11, 2024

Summarize Article

Table of Contents

ToggleA fintech platform delivers financial services like payments, lending, and investing using technology, often without traditional banks.

The fintech stage is playing a pivotal role in the provision of financial services in this age of digitization. A financial technology platform allows businesses to provide any type of financial services in a more friendly, efficient, and cost-effective manner using modern technology. Whether you are a disruptive startup or an incumbent looking to renew, knowing what works in a fintech platform is very important.

A Fintech platform is a tech-based ‘network’ that houses all the peripheral devices and technologies involving the provision of financial services to the people. Its primary focus is to act as a base for offering various functioning services such as mobile banking, digital payments, P2P lending, and investment management among many others. Thanks to the Fintech technology, companies can enhance their efficiency both in costs and in the manner in which they offer services.

Among the key features of financial technology is its simplicity of use. Fintech end-users are culture-oriented and only seek for necessities with ease of use and full experience performance. Hence an efficient fintech platform must guarantee a pleasant process of client registration, easy finding of the needed service, and fast rendering of the services.

The application’s streamlined and simplistic design means even the simplest of users can carry out equity trades without any complication.

In the financial technology industry, security is paramount. Due to the rise in online threats like cyber-attacks and data breaches, the security measures imposed on fintech platforms have to be complex and advanced. Data hiding, biometric password systems, and surveillance are some of the protective measures that carry a lot of weight in securing financial data.

Equally, adherence to regulations is not optional. Fintech players have to also observe the relevant laws such as the GDPR, PCI DSS, and links to the geographical areas in which they are active.

The architectural backbone of any contemporary fintech is API (Application Programming Interface) integrations. This allows fintech players to incorporate other financial systems, external applications, and services. This, in turn, offers the possibility to the platforms to expand their service offerings without the need to develop everything already existing in the market.

For instance, after users submit their banking credentials, Plaid allows fintech apps to “lace” into their users’ bank accounts and share information securely.

Scaling ability is among the most outstanding features of fintechs that guarantee their survival for years. Each time your fintech grows, the provided platform will have a lot of transactions to manage, more users, and even more diverse services without timidity on performance. Scalability is a must if one intends to enhance the productivity of the operations as the company grows.

Stripe is one of the most visible online payments and has been designed to be scalable within the fintech context.

Consumers in the present-day competitive environment have a clear expectation of the financial services being offered to them. For any fintech platform to be successful it ought to apply business intelligence and machine learning in a bid to provide consumers with appropriate suggestions, offers, and experiences respectively.

Wealthfront has an automated investment service that has brought the topic of wealth management closer to the users.

With the increase in mobile users, a mobile-engaging financial technology platform is a must-have. Users wish to control their finances even as they move hence the optimal social media platform in the financial technology industry should also be mobile fast and efficient.

Chime, a new bank that offers mobile banking exclusively to its users is a good illustration of this.

The application of AI and machine learning in financial technology is more focused on the enhancement of decision-making, risk management, and the provision of customer services. AI–based chat-bots, predictive analytics, virtual agents, and the like are some of how AI is applied in Fintech.

As a good case in point, ZestFinance uses algorithms to estimate the credit scores of people without credit paperwork.

Ui Speed is of the essence when it comes to Fintech. Users today expect instant payments, transfers, and access to the physical and electronic global financial systems. A working fintech would therefore incorporate real-time transaction capabilities, which gives the users control over their funds immediately.

To illustrate, Venmo is an application that gets money to or from a user’s account quickly, without them having to do anything instantaneously.

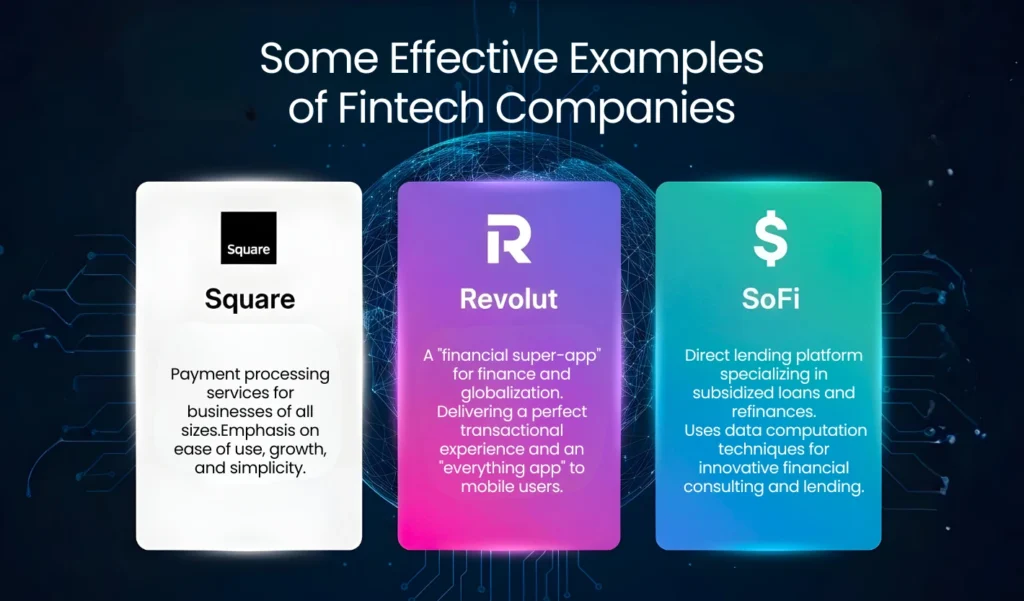

Some examples of fintech companies illustrate what digital financial technology is and how to manage it successfully – building the right focused fintech features on the platform:

Such examples of fintech companies highlight the essence of not just the development of the platform but the constructive evolution of the user experience, security features, and the importance of being scalable and customizable.

There are essential fintech features and technologies that ought to be adopted to meet the user needs, security measures, and even the strategy to scale the business. They don’t have to compromise on the quality of the offering to the users to create a profitable fintech model. If the attitude is slanted towards how the users perceive the product, security issues, use of APIs, scaling, and customization, fintech solutions can be successful.

Unlock exclusive insights and expert knowledge delivered straight to your inbox