Table of Contents

ToggleAt present, e-commerce has been on the rise at an astonishing rate. Every day millions of customers buy products through the internet. Yet such growth also implies an increased demand for safe means of payment. Customers require assurance that their sensitive information remains protected while companies must ensure a seamless and safe transaction process. This is why the importance of a secure payment gateway in e-commerce development cannot be overstated.

1. What Is a Secure Payment Gateway?

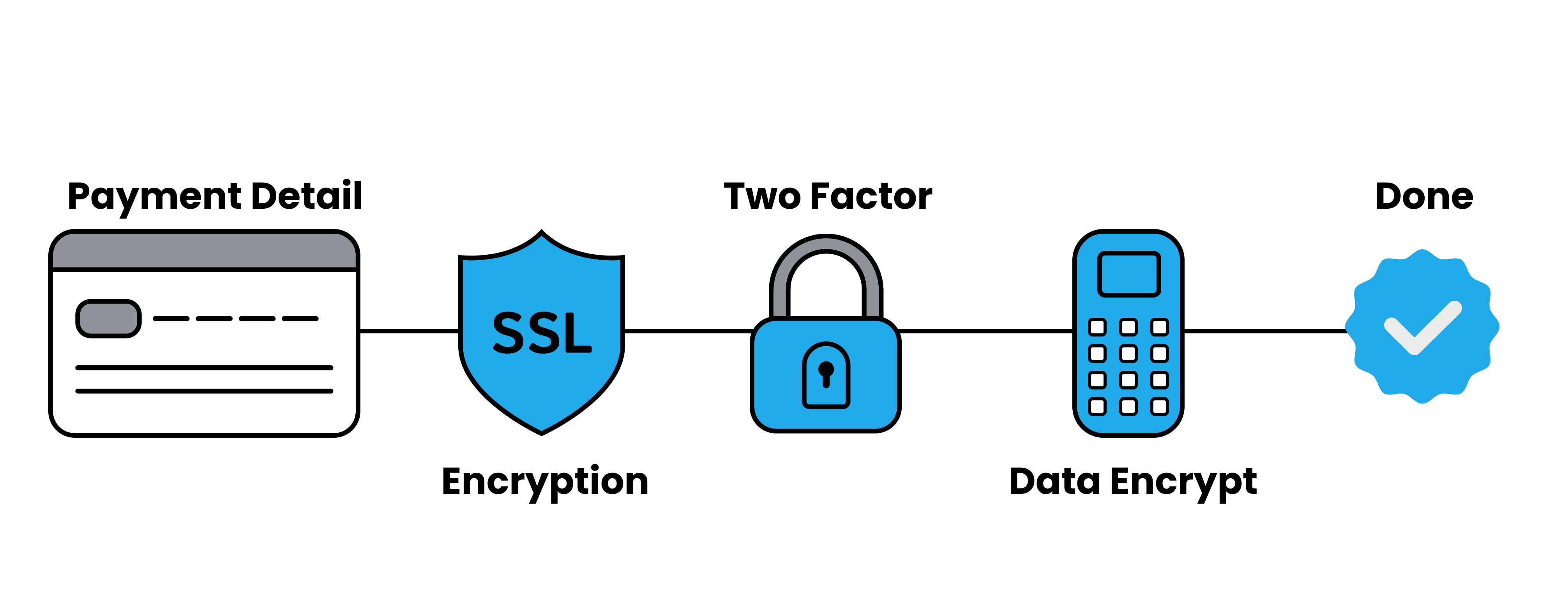

A secure payment gateway acts as an intermediary between a customer’s bank and a merchant’s website by processing credit card payments for businesses running online. It employs encryption to protect sensitive financial information like credit card details such that unauthorized persons cannot access it. This kind of security is crucial in enhancing customer confidence as it promotes secure online transactions.

2. The Role of Payment Gateway Security in E-Commerce

Encryption, authentication, and tokenization form payment gateway security’s core elements. Let us delve into the reasons behind these features:

- Encryption: This means that when you integrate a secure payment gateway, it encrypts customer data which means, that if a hacker is trying to get hold of such information they will not use it for any other purpose.

- Authentication: By requiring your customers to provide additional verification (for example a text message code), you are improving protection for your e-commerce solutions for payment.

- Tokenization: Tokenization substitutes delicate payment details for unique identification symbols known as tokens that cannot serve any purpose other than carrying out that particular transaction.

3. Implementing Payment Integration for Seamless Transactions

For proper payment integration on your e-commerce website, you should:

- Review the Integration: The last thing you want is to launch your site and realize that it doesn’t work on some devices or does not support certain payment options such as credit cards, debit cards, or digital wallets like Apple Pay and Google Pay.

- Payment Gateway Performance Monitoring: Keep an eye on the payment gateway performance once it has been integrated. Confirm that there are no transaction processing issues and that customers do not face any delays related to payments or errors.

- Select The Suitable Payment Gateway Provider: When selecting a gateway for all transactions, it is advisable to evaluate the security levels of different companies. Among the most preferred alternatives are PayPal, Stripe, and Square due to their compatibility with different shopping carts.

4. SSL for E-Commerce: A Must-Have for Security

A Secure Sockets Layer (SSL) is a protocol for creating a secure connection between a web server and an online browser. Here’s why SSL for ecommerce is necessary for secure online transactions:

- Data Encryption: All data going to or coming from clients to your e-commerce site through SSL gets encrypted.

- Instills Confidence: The presence of a padlock emblem and the use of “https” within their web addresses demonstrate to customers that these sites are secure.

- Prevents Phishing Scams: SSL certificates guarantee that only the authorized payee (payment processor) receives the information sent.

- Compliance with PCI Standards: E-commerce organizations should adhere to PCI standards, which stipulate that SSL certificates are obligatory to guarantee safe

5. E-Commerce Payment Solutions for Your Customers’ Improved Experience

- Mobile Payment Systems: Alongside the use of credit cards and debit cards, integrate additional user-friendly payment solutions such as Apple Pay, Google Pay, and PayPal. These services provide faster scanning periods and extra security measures during payments.

- Express Payments: For frequent clients, implement express payment options without any hurdles. This functionality will securely save a client’s payment details for future transactions, allowing for very fast repeat purchases.

- Support for Multiple Currencies: If you are selling items to different countries, then your payment gateway should allow multi-currency transactions. This enhances the user’s experience, irrespective of the user’s geographical location.

6. Best Practices for Secure Online Transactions

In addition to deploying a secure payment gateway and SSL encryption for online transactions, there are some other best practices to adopt. For instance:

- Ensure Updating Of Systems: Make certain that the e-commerce system, payment portals, and any other program related to them is updated regularly due to possible threats.

- Carry Out Regular Security Checks: Carry out checks on your website from time to time as regards security measures with particular emphasis on the checkout and payment processing sections.

- Customer Education: Include on-site information about how their information is safeguarded, where practical. It is recommended that you include some frequently asked questions help pages on your site.

Conclusion

There is no need to mention how critical a payment gateway is for an online business. As online fraud is increasing, every business must prioritize security for the sake of their customers and their image. For effective payment gateway fraud protection, use SSL for e-commerce and provide an e-commerce payment solution. Customer trust can be achieved and maintained while assuring customers of their safety while paying online.