Are you ready to disrupt with AI? Join our Hackathon today! Click to Register

By WebOsmotic Team | Published on January 27, 2025

Summarize Article

Table of Contents

ToggleAI trading bots are transforming how investments are managed in this rapid world of financial markets. These bots make trades through artificial intelligence, analyze market trends, and adjust investment strategies without human interference. Whether a seasoned investor or an amateur venturing into the stock market, recognition of AI trading bots can bring many advantages your way.

This article explores the basics, advantages, and pitfalls of using AI trading bots in an insightful approach, mainly guiding people about its operations and utilization, especially those new to this concept. It explains how such sophisticated tools are revolutionizing investment practices globally and how their implementation in India will further facilitate and evolve this system.

AI trading bots involve automated software programs utilizing algorithms and artificial intelligence to execute trading activities. Before making ideal trading decisions, these bots analyze market data such as price movements, trading volumes, and historical trends. Unlike traditional trading, where orders are placed manually, AI trading bots run 24/7, ensuring no trading opportunities are left unexploited.

AI trading bots employ machine learning models to adapt to changes in market conditions, thus continuously improving performance. Scalping, arbitrage, or trend following are some strategies these bots can perform. For example, an exceptional AI trading bot would spot profitable trades by learning patterns and projecting future price movements.

These are mostly beneficial for volatile markets since this type of market requires quick decision-making. For seasoned and AI trading bot for beginners, these bots are as systematic as possible about the trading approach, showing reduced emotional biases often associated with manual trading.

AI trading bots have revolutionized the trading landscape by offering unparalleled advantages. Here’s why they’re worth considering:

Lightning-Fast Data Analysis

AI trading bots can process and analyze vast datasets incredibly quickly, identifying and executing profitable trades faster than any human.

24/7 Operation

Bots run continuously without breaks, ensuring no trading opportunities are missed, unlike humans who need rest or may be distracted by daily activities.

Emotion-Free Trading

AI bots eliminate emotional decision-making, such as fear or greed, providing a disciplined approach to trading that adheres strictly to pre-defined strategies and rules.

Backtesting Strategies

These bots can backtest trading strategies using historical data, helping traders refine their methods before applying them in real-time markets.

Convenience and Mobility

AI trading apps make it easy to monitor and manage trades on the go, with automated alerts and real-time updates keeping traders informed and ready to adjust their strategies as needed.

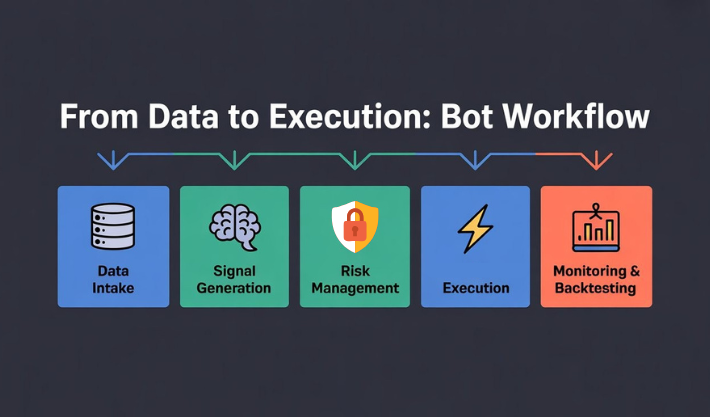

The working mechanism of AI trading bots involves the major components, including data collection, signal generation, risk management, and execution. First, the bot starts collecting real-time market data coming from various sources. These may include stock exchange data, news outlets, or social media channels. Data will then be filtered through algorithms designed to identify suitable trading signals.

The bot assesses the risks of a particular potential trade and selects the best possible entry and exit points. Calculations for determining stop-loss and take-profit levels are done, and it helps minimize loss and maximize profits. The bot automatically executes the trade on behalf of the user.

Well, for those inquisitive minds, do AI trading bots work? Of course, that depends on the quality of algorithms and data being used. The best AI trading bot uses sophisticated algorithms and proper risk management to ensure consistent performance in different market conditions.

Among the digital tools, AI trading bots have recently emerged as a popular one in India thanks to qualitative changes in people’s daily lives. Many Indian traders and investors are applying these automated tools to boost their strategies and increase the rate of profitability.

The most obvious reason behind the growth of AI trading bot India is due to readily available trading applications and trading platforms with features residing on artificial intelligence. These platforms offer the users a relatively simplified interface to enable those new to trading and even complex artificial trading algorithms for professional traders. Moreover, the characteristics of the Indian market, including high volatility and availability of a wide range of assets suitable for trading are ideal for the performance of the AI trading bots.

Apart from that, the improvement of rule-making procedures and the enhancement of the public’s understanding of the automatic trading system have ensured a rising acceptance of trading bots in the Indian market. With an increasing number of investors seeing the benefit of these tools, the AI trading apps and platforms market will expand even more as they change the face of trading in India.

Many ai trading bots are available, but we have listed the top 5 most efficient ones:++

| AI Trading Bot | Key Features | Best For | Supported Exchanges | Unique Selling Point |

|---|---|---|---|---|

| CryptoHopper | – Cloud-based- Customizable strategies- Backtesting- Automated trading 24/7 | Beginners and experienced traders | Multiple | User-friendly interface with advanced strategy integration |

| TradeSanta | – Grid and DCA strategies- Real-time performance tracking- Mobile app support | Traders of all levels | Multiple | Easy setup and mobile accessibility |

| 3Commas | – Smart trading terminals- Portfolio management- Copy trading | Novice and professional traders | Various | Advanced risk management tools and versatility |

| Shrimpy | – Portfolio rebalancing- Index-based trading- Performance analytics | Traders focusing on long-term, balanced investments | Multiple | Automated portfolio management for minimal manual intervention |

| Gunbot | – Extensive customization- Trailing stop- Dollar-cost averaging- Multiple strategies | Advanced traders seeking detailed control over their trading | Numerous | High configurability and support for a wide range of trading strategies |

CryptoHopper is a cloud-based AI trading bot known for its user-friendly interface and powerful features. It supports multiple exchanges and offers customizable strategies, backtesting, and automated trading 24/7. Suitable for both beginners and experienced traders, CryptoHopper integrates with various technical indicators, enabling users to create and implement their unique trading strategies.

TradeSanta is an AI trading bot designed to automate cryptocurrency trades. It features grid and DCA (Dollar-Cost Averaging) strategies, making it ideal for traders looking to capitalize on market fluctuations. TradeSanta offers a straightforward setup process, real-time performance tracking, and a user-friendly mobile app, making it accessible for traders of all levels.

3Commas is a versatile AI trading bot that supports various exchanges and trading pairs. It offers features like smart trading terminals, portfolio management, and copy trading. With advanced tools for risk management and customizable strategies, 3Commas caters to novice and professional traders, helping them optimize their trading performance.

Shrimpy is a portfolio management and AI trading bot focused on long-term investment strategies. It allows users to automate portfolio rebalancing and index-based trading. Shrimpy supports multiple exchanges and provides performance analytics, making it suitable for traders aiming to maintain a balanced crypto portfolio with minimal manual intervention.

Gunbot is a highly configurable AI trading bot that offers extensive customization options for trading strategies. It supports numerous exchanges and trading pairs, allowing users to tailor their trading experience. Gunbot provides features like trailing stop, dollar-cost averaging, and multiple built-in strategies, making it a powerful tool for advanced traders seeking full control over their trades.

The best AI trading bot has to be selected after considering several parameters, such as reliability, performance, and ease of use. A reliable AI trading bot should have consistent performance records under varying conditions. Transparency in reporting and real performance metrics should be looked for in bots so that the user can evaluate how effective it is.

The second main factor would be ease of use, which for a novice can be critical. An easy interface and thorough resource support may facilitate the use by traders who install and handle the bots more readily. Besides this, a rich set of customization options and important features like risk management tools might give users better trading strategy control.

Security is also a critical consideration. The best AI trading bot should use robust encryption and secure protocols to protect user data and funds.

AI trading bots are transforming the investment landscape by providing traders of all levels with automated data-driven solutions. Benefits include increased efficiency, reduced emotional bias, and 24/7 operation. Whether you are exploring AI trading for beginners or optimizing your trading strategies, AI trading bots are an asset you should consider. As technology develops, these bots will develop even more, bringing new possibilities for investors worldwide. Accept the future of trading through AI-driven automation to unlock your potential investment.

Unlock exclusive insights and expert knowledge delivered straight to your inbox