This guide is simple and useful. You will see quick trends, a clean table, and short notes on 30 standout teams. Revenue figures use the latest solid reports or careful estimates. When numbers are not public about AI startups in US, you will see Undisclosed. For fast checks, each key claim links to a source.

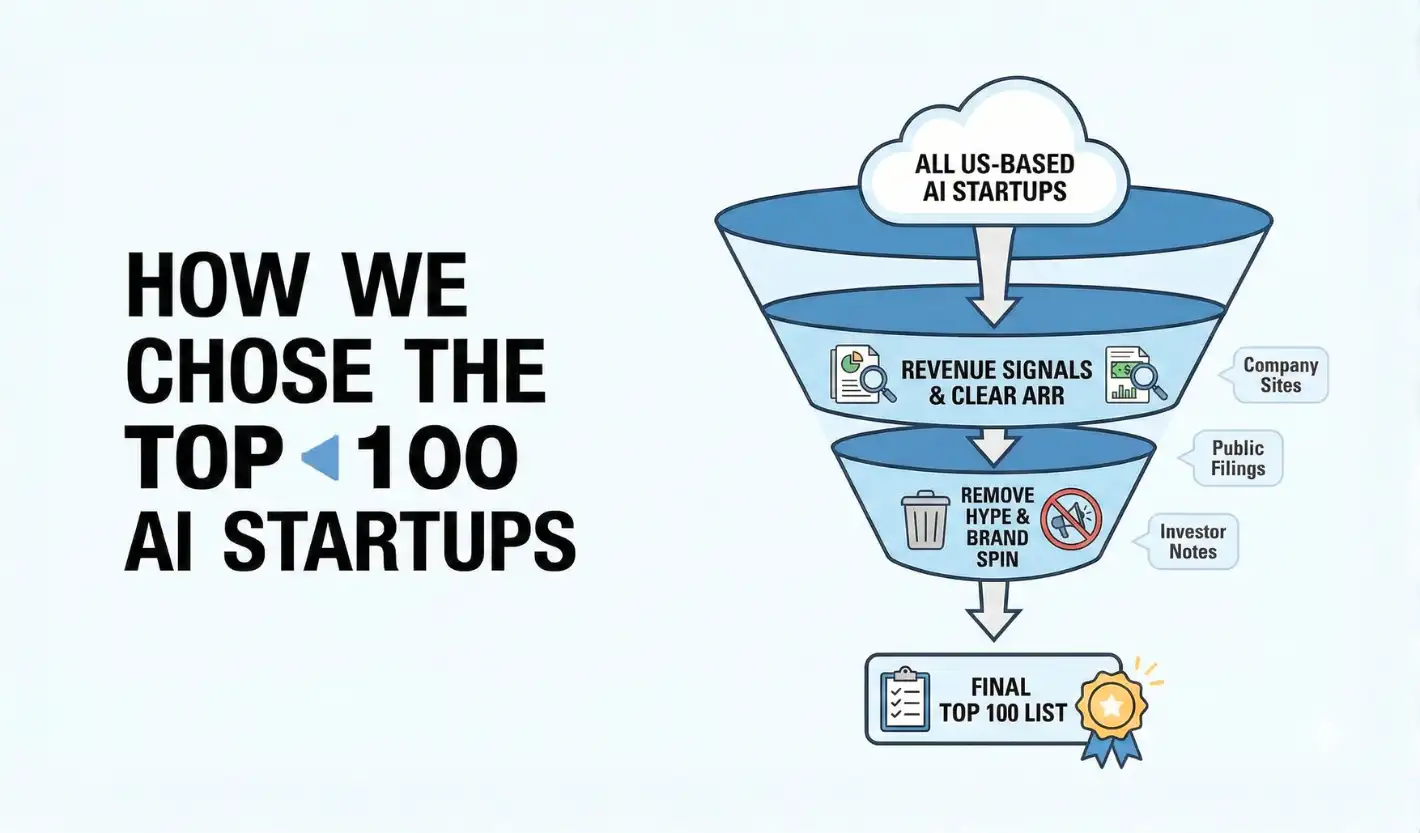

Each pick has a US base and real AI at the core. We looked for revenue signals and clear ARR from trustworthy sources. To build the table, we gathered data using company sites and public filings. We also used investor notes and trusted media.

Numbers without solid backing appear as Undisclosed. We removed hype-only projects and brand spin. We avoided duplicate units under one parent. We aimed for balance across infra and apps so readers get a full view. Last, we checked headcount against revenue to gauge efficiency and momentum. Each line reflects the best, most current picture we could validate.

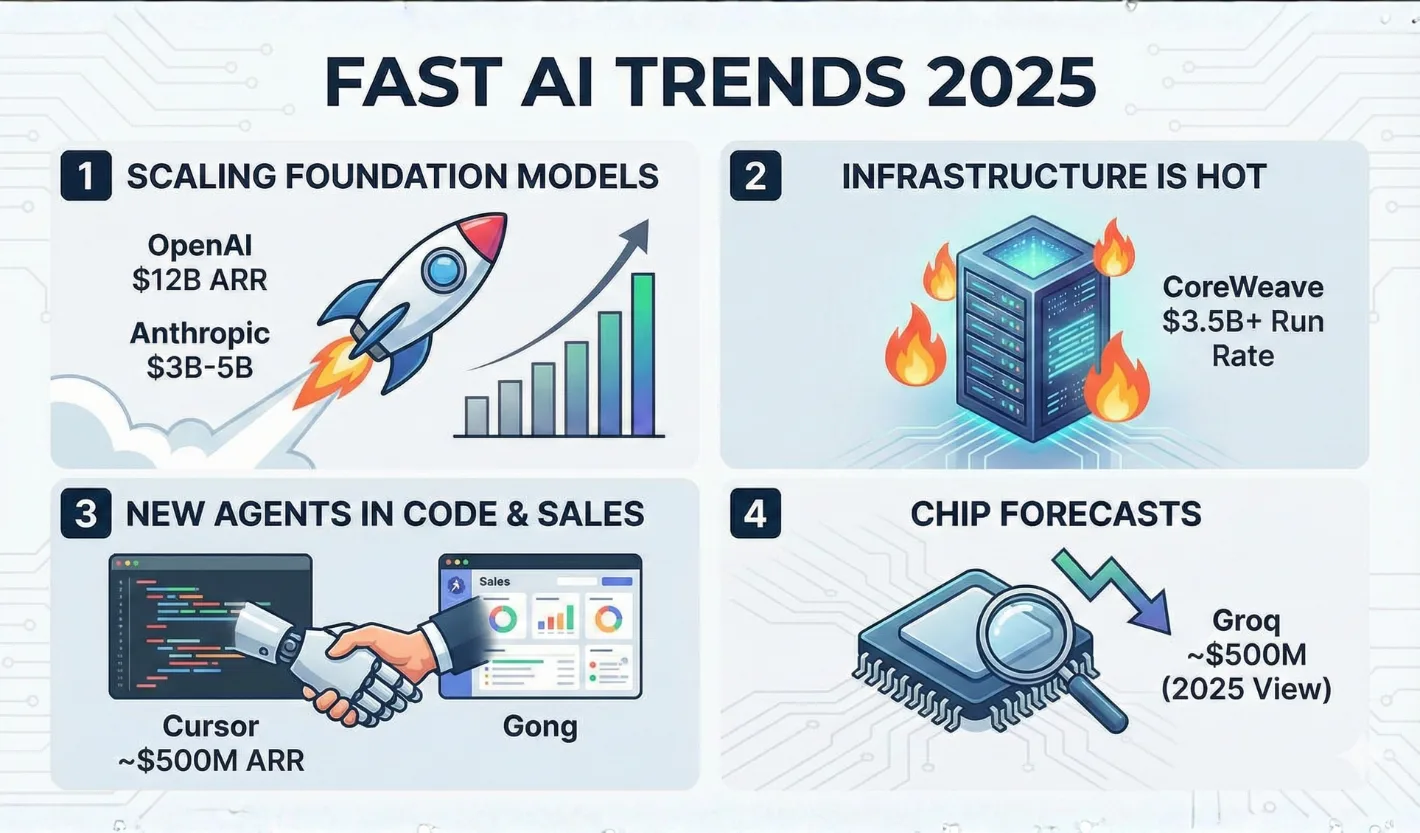

Before starting our list of the top 100 AI startup companies, let’s cherish some fast trends of 2025

| No. | Company | Founding Year | Annual Revenue (latest) |

| 1 | OpenAI | 2015 | ~$12B ARR (est.) |

| 2 | Anthropic | 2021 | ~$3B–$5B ARR (est.) |

| 3 | xAI | 2023 | ~$500M-$5 billion (est.) |

| 4 | Databricks | 2013 | ~$3.7B ARR (est.) |

| 5 | CoreWeave | 2017 | ~$3.5B LTM (reported) |

| 6 | Scale AI | 2016 | ~$2B 2025 ARR (est.) |

| 7 | Perplexity AI | 2022 | ~$148M ARR (est.) |

| 8 | Cursor (Anysphere) | 2022 | ~$500M ARR (reported) |

| 9 | Replit | 2016 | ~$100M ARR (est.) |

| 10 | Midjourney | 2022 | ~$500M ARR (est.) |

| 11 | Runway | 2018 | ~$90M ARR (est.) |

| 12 | Character.AI | 2021 | ~$30M ARR (mid-2025 est.) |

| 13 | Groq | 2016 | ~$500M 2025 projection |

| 14 | Cerebras Systems | 2016 | ~$272M 2024 (est.) |

| 15 | SambaNova Systems | 2017 | ~$100-150M (est.) |

| 16 | Glean | 2019 | ~$100M ARR (reported) |

| 17 | Harvey | 2022 | ~$100M ARR (reported) |

| 18 | Otter.ai | 2016 | >$100M ARR (reported) |

| 19 | Abridge | 2018 | ~$100M ARR (est.) |

| 20 | Ambience Healthcare | 2020 | ~$30M ARR (est.) |

| 21 | Hippocratic AI | 2023 | ~$10-50M ARR (est.) |

| 22 | Hugging Face | 2016 | ~$130M 2024 (est.) |

| 23 | Pinecone | 2019 | ~$26.6M 2024 (est.) |

| 24 | LangChain | 2022 | ~$12-$16M (est.) |

| 25 | Writer | 2020 | ~$47M ARR (est.) |

| 26 | Jasper | 2021 | ~$88 million (est.) |

| 27 | ElevenLabs | 2022 | ~$207–$220M ARR (est.) |

| 28 | Adept AI | 2022 | ~$75M ARR (est.) |

| 29 | Figure AI | 2022 | ~$13.3M ARR (est.) |

| 30 | Shield AI | 2015 | ~$60M ARR (est.) |

| 31 | Anduril Industries | 2017 | ~$2 billion ARR (est.) |

| 32 | Skydio | 2014 | ~$180 million ARR (est.) |

| 33 | Nuro | 2016 | ~$194.8 million ARR (est.) |

| 34 | Aurora Innovation | 2017 | ~$1 million ARR (est.) |

| 35 | Zipline | 2014 | ~$187.4 million ARR (est.) |

| 36 | Kodiak Robotics | 2018 | ~$50–$100 million ARR (est.) |

| 37 | Covariant | 2017 | ~$10–$50 million ARR (est.) |

| 38 | Standard AI | 2017 | ~$10-$50M ARR (est.) |

| 39 | Focal Systems | 2016 | ~$8.9 million ARR (est.) |

| 40 | Humane | 2018 | ~$29.6 million ARR (est.) |

| 41 | Rabbit Inc. | 2023 | ~5.17B ARR (est.) |

| 42 | People.ai | 2016 | ~$62.8 million ARR (est.) |

| 43 | Observe.AI | 2017 | ~$11.3 million ARR (est.) |

| 44 | Forethought | 2018 | ~$10–$50 million ARR (est.) |

| 45 | Moveworks | 2016 | ~$1.32 million ARR (est.) |

| 46 | Descript | 2017 | ~$10M-$50M ARR (est.) |

| 47 | Tome | 2020 | ~$18.8M ARR (est.) |

| 48 | Hebbia | 2020 | ~$13M ARR (est.) |

| 49 | Abacus.AI | 2019 | ~$17.2M ARR (est.) |

| 50 | Vercel | 2015 | ~$200M ARR (est.) |

| 51 | Together AI | 2023 | ~$130M ARR (est.) |

| 52 | OctoAI (OctoML) | 2019 | ~$17.1M ARR (est.) |

| 53 | Predibase | 2021 | ~$4.3M ARR (est.) |

| 54 | Luma AI | 2021 | ~$29.9M ARR (est.) |

| 55 | Pika Labs | 2023 | ~$66.7M ARR (est.) |

| 56 | Hume AI | 2020 | ~$5.5M ARR (est.) |

| 57 | Reka AI | 2023 | ~$10.9M ARR (est.) |

| 58 | Fixie AI | 2022 | ~$478.4K ARR (est.) |

| 59 | Dust | 2022 | ~$1.96B ARR (est.) |

| 60 | Runpod | 2022 | ~$10.7M ARR (est.) |

| 61 | Lambda Labs (Lambda) | 2013 | ~$250M ARR (est.) |

| 62 | Weights & Biases* | 2017 | ~$50M ARR (late-2024 est.) |

| 63 | Coactive AI | 2021 | ~$3.8M ARR (est.) |

| 64 | Observe Inc. | 2017 | ~$44.2M ARR (est.) |

| 65 | Modular AI | 2022 | ~$2M ARR (est.) |

| 66 | Anyscale | 2019 | ~$111.9M ARR (est.) |

| 67 | OpenEvidence | 2020 | ~$50M ARR (est.) |

| 68 | Viz.ai | 2016 | ~$40.0M ARR (est.) |

| 69 | PathAI | 2016 | ~$10–$100M ARR (est.) |

| 70 | Freenome | 2014 | ~$132.1M ARR (est.) |

| 71 | Recursion | 2013 | ~$132.1M ARR (est.) |

| 72 | Insitro | 2018 | ~$64.51M ARR (est.) |

| 73 | Abnormal Security | 2018 | ~$126M ARR (est.) |

| 74 | Vectara | 2022 | ~$25M ARR (est.) |

| 75 | Gretel.ai | 2020 | ~$15.8M ARR (est.) |

| 76 | Foxglove | 2021 | ~$4.1M ARR (est.) |

| 77 | Etched AI | 2024 | ~$120M ARR (est.) |

| 78 | d-Matrix | 2019 | ~$15M ARR (est.) |

| 79 | Deepgram | 2015 | ~$21.8M ARR (est.) |

| 80 | AssemblyAI | 2017 | ~$17M–$37M (est.) |

| 81 | Snorkel AI | 2019 | ~$36.8M ARR (est.) |

| 82 | Labelbox | 2017 | ~$50M ARR (est.) |

| 83 | Clarifai | 2013 | ~$35M ARR (est.) |

| 84 | DataRobot | 2012 | ~$285M ARR (est.) |

| 85 | H2O.ai | 2011 | ~$67.8M ARR (est.) |

| 86 | Domino Data Lab | 2013 | ~$22.6M ARR (est.) |

| 87 | Baseten | 2019 | ~$2.7M ARR (est.) |

| 88 | Replicate | 2022 | ~$5.3M ARR (est.) |

| 89 | Modal Labs | 2022 | ~$5.4M ARR (est.) |

| 90 | Lightning AI | 2019 | ~$11.7M ARR (est.) |

| 91 | Arize AI | 2020 | ~$12.4M ARR (est.) |

| 92 | WhyLabs | 2020 | ~$10.6M ARR (est.) |

| 93 | Fiddler AI | 2018 | ~$15M ARR (est.) |

| 94 | Truera | 2019 | ~$23.8M ARR (est.) |

| 95 | Tecton | 2019 | ~$24-28M ARR (est.) |

| 96 | Featureform | 2022 | ~$1.3M ARR (est.) |

| 97 | LlamaIndex | 2023 | ~$10M ARR (est.) |

| 98 | Cleanlab | 2021 | ~$3.2M ARR (est.) |

| 99 | Inworld AI | 2021 | ~$11.3M ARR (est.) |

| 100 | Typeface | 2022 | ~$8M ARR (est.) |

Founding Year: 2015

Founded by: Sam Altman and Greg Brockman

Annual Revenue: ~$12B ARR (est.)

Description: Creator of ChatGPT and GPT-4o. Massive demand across consumer chat and enterprise APIs. Growth is powered by model upgrades and a strong partner stack.

Founding Year: 2021

Founded by: Dario Amodei and Daniela Amodei

Annual Revenue: ~$3B–$5B ARR (est.)

Description: The Claude family aims for safe and capable assistants. Enterprise deals and model quality drive rapid scale in 2025.

Founding Year: 2023

Founded by: Elon Musk and team

Annual Revenue: ~$500M-$5 billion (est.)

Description: Grok models target speed and scale. Heavy compute plans and frequent model drops keep attention high.

Founding Year: 2013

Founded by: Ali Ghodsi and Matei Zaharia

Annual Revenue: ~$3.7B ARR (est.)

Description: Data and AI platform with lakehouse, MLflow, and Mosaic stack. Strong AI workload pull across large teams.

Founding Year: 2017

Founded by: Michael Intrator and Brian Venturo

Annual Revenue: ~$3.5B LTM (reported)

Description: AI cloud built around Nvidia GPUs. Big backlog, rapid data center rollout, and strong partner ties.

Founding Year: 2016

Founded by: Alexandr Wang and Lucy Guo

Annual Revenue: ~$2B 2025 (est.)

Description: Data, eval, and agent testing suite for big AI programs. Momentum tied to eval and red-teaming.

Founding Year: 2022

Founded by: Aravind Srinivas and Denis Yarats

Annual Revenue: ~$148M ARR (est.)

Description: An answer engine seeing rapid growth in both queries and paid Pro subscriptions. Strong mobile traction and enterprise pilots.

Founding Year: 2022

Founded by: Michael Truell and Arvid Lunnemark

Annual Revenue: ~$500M ARR (reported)

Description: AI code editor that ships quickly and monetizes teams. Pricing power and speed fuel word-of-mouth growth.

Founding Year: 2016

Founded by: Amjad Masad and Haya Odeh

Annual Revenue: Undisclosed

Description: AI agents meet cloud IDE. Big creator base and a deeper enterprise push in 2025.

Founding Year: 2022

Founded by: David Holz and team

Annual Revenue: ~$500M ARR (est.)

Description: Image and video creation at high quality. Loyal community and rising partnerships boost reach.

Founding Year: 2018

Founded by: Cristóbal Valenzuela and Anastasis Germanidis

Annual Revenue: ~$90M ARR (est.)

Description: Text-to-video pioneer with Gen-4 and creative tools. Strong film and studio usage.

Founding Year: 2021

Founded by: Noam Shazeer and Daniel De Freitas

Annual Revenue: ~$30M ARR (mid-2025 est.)

Description: Consumer chat companions with deep engagement. New commerce paths unlock fresh growth levers.

Founding Year: 2016

Founded by: Jonathan Ross and Douglas Wightman

Annual Revenue: ~$500M 2025 projection

Description: LPU-powered inference at high speed and low cost. Big pipeline shifts guidance yet demand stays strong.

Founding Year: 2016

Founded by: Andrew Feldman and Michael James

Annual Revenue: ~$272M 2024 (est.)

Description: Wafer-scale compute for training and inference. Large deals anchor growth, with a wider customer mix in focus.

Founding Year: 2017

Founded by: Rodrigo Liang and Kunle Olukotun

Annual Revenue: Undisclosed

Description: Full-stack AI platform with inference focus and data center offers. New turnkey stack aims at fast rollout.

Founding Year: 2019

Founded by: Arvind Jain and Tony Gentilcore

Annual Revenue: ~$100M ARR (reported)

Description: Work AI that unifies search, chat, and automation inside one platform. Strong expansion in large accounts.

Founding Year: 2022

Founded by: Winston Weinberg and Gabe Pereyra

Annual Revenue: ~$100M ARR (reported)

Description: Legal co-pilot for firms and in-house teams. New office leases and rapid hiring signal scale.

Founding Year: 2016

Founded by: Sam Liang and Yun Fu

Annual Revenue: >$100M ARR (reported)

Description: AI meeting agents and summaries for teams. Enterprise proof points accelerate adoption.

Founding Year: 2018

Founded by: Shiv Rao and Sandeep Konam

Annual Revenue: ~$100M ARR (est.)

Description: Clinical notes and coding for health systems. Accuracy and workflow fit drive stickiness.

Founding Year: 2020

Founded by: Mike Ng and team

Annual Revenue: ~$30M ARR (est.)

Description: Ambient scribing and care AI. Hospitals see faster notes and lower burnout.

Founding Year: 2023

Founded by: Munjal Shah and team

Annual Revenue: ~$10-50M ARR (est.)

Description: Safety-first health agents with focus on voice and triage. Pilots grow across provider networks.

Founding Year: 2016

Founded by: Clément Delangue and Julien Chaumond

Annual Revenue: ~$130M 2024 (est.)

Description: Model hub and enterprise hosting. Revenues span plans, support, and private installs.

Founding Year: 2019

Founded by: Edo Liberty

Annual Revenue: ~$26.6M 2024 (est.)

Description: Vector database used in RAG stacks at scale. Strong mindshare with builders.

Founding Year: 2022

Founded by: Harrison Chase

Annual Revenue: ~$12-$16M (est.)

Description: Framework plus platform for LLM apps. Large developer base and steady enterprise pull.

Founding Year: 2020

Founded by: May Habib and Waseem AlShikh

Annual Revenue: ~$47M ARR (est.)

Description: Enterprise content and agent studio with governance built in. Strong suit in compliance-heavy teams.

Founding Year: 2021

Founded by: Dave Rogenmoser and Chris Hull

Annual Revenue: ~$88 million (est.)

Description: Marketing copilot with templates and brand guardrails. Moving upmarket with team seats.

Founding Year: 2022

Founded by: Piotr Dabkowski and Mateusz Staniszewski

Annual Revenue: $207–$220M ARR (est.)

Description: Voice synthesis with rich API and creator tools. Expands into dubbing and safety features.

Founding Year: 2022

Founded by: David Luan and Ashish Vaswani

Annual Revenue: $75M ARR (est.)

Description: Agent tech and model talent continued inside Amazon after a licensing move. Interest in enterprise workflows stays high.

Founding Year: 2022

Founded by: Brett Adcock and team

Annual Revenue: $13.3M ARR (est.)

Description: Humanoids aimed at real work. Big partners and fast hardware cycles keep buzz strong.

Founding Year: 2015

Founded by: Brandon Tseng and Ryan Tseng

Annual Revenue: ~$60M ARR (est.)

Description: Autonomy stack for defense. Focus on contested airspace and edge computation.

These were some of the top AI startups in the US. Keep in mind that the est. revenue described for each company is backed by thorough research. However, the metrics might change with time.

Ship clear value. Show working demos and short case studies. Share paid pilots and real ARR, and focus on one use case and one ideal buyer. Besides that, you need to:

Want a review? Send a short deck and two customer contacts.

We track clear traction and a real AI core. We look at product speed and customer proof. We consider funding signals and partnerships besides checking public revenue hints. Teams that show strong value get a higher chance.

Yes, if there is momentum. Paid pilots and a tight ICP help. A crisp demo helps as well. We value real usage and repeatable value more than hype.

We use trusted reports and investor notes. We mix in pricing pages and customer counts. We cross-check with hiring signals and press notes. If data looks shaky, we mark it as Undisclosed and keep it that way.

It is a simple ratio. Take annual revenue and divide it by headcount. The number shows efficiency. Higher can mean strong pricing or lean ops. Lower can mean a growth phase or heavy R&D. Context matters, so read it with care.

Yes. You need clear traction. Paid pilots help a lot. Strong waitlists help. A tight niche with real pain helps. Show depth in one workflow, and you can still shine.

Send a short deck and two customer contacts. Include your ICP and one core use case. Add ARR or pilot size if possible. Share a link to the docs and a short demo video. Keep it simple and clear.

Private teams often keep numbers quiet. Sometimes reports clash. In such cases, we avoid guesses. We place Undisclosed and monitor new signals. When a solid figure appears, we update the table with care. Accuracy beats speed here.